The 110 Million EUR Opportunity: Investing in Latvian Loan Marketplace Platforms

Back in early 2015 the words “marketplace lending” and “Latvia” would have hardly been spoken in the same sentence. Now, in mid-2018 investors are spoiled for choice with opportunities to invest in platforms covering consumer loans, invoice financing and real estate. We chart the rise of loan marketplace platforms and offer an estimate on the size of the current investment opportunities.

The Rise of the Loan Marketplace Platform

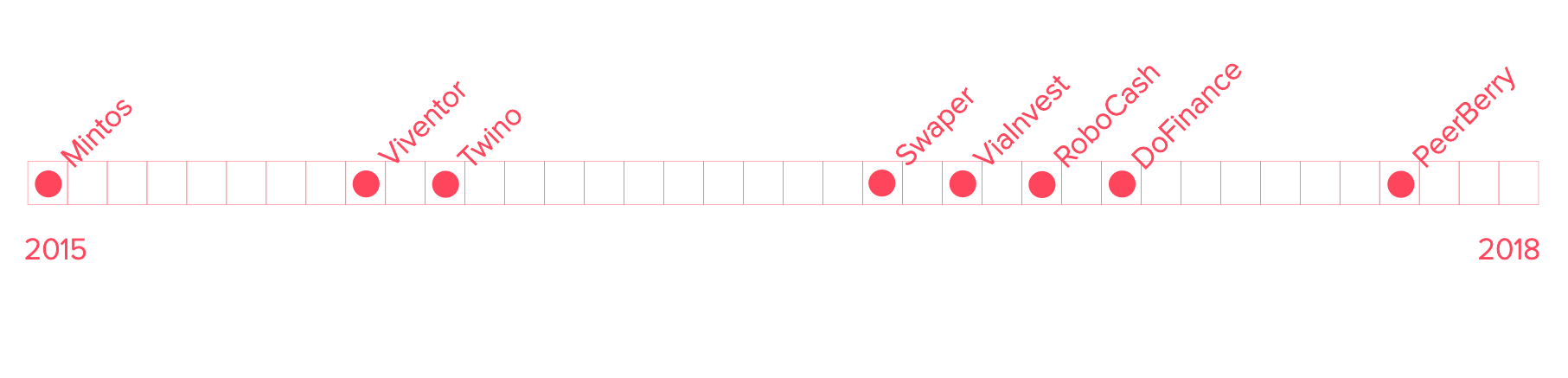

Following some back and forth with the local regulatory authorities regarding whether and how peer-to-peer lending is possible within the legislative framework of Latvia, Mintos launched in early 2015. As the dust around the subject of peer-to-peer lending started to settle, other platforms soon followed – Viventor and Twino in late 2015, Swaper in late 2016 and a host of other platforms throughout 2017 and 2018.

Following some back and forth with the local regulatory authorities regarding whether and how peer-to-peer lending is possible within the legislative framework of Latvia, Mintos launched in early 2015. As the dust around the subject of peer-to-peer lending started to settle, other platforms soon followed – Viventor and Twino in late 2015, Swaper in late 2016 and a host of other platforms throughout 2017 and 2018.

Interestingly, none of the Latvia based platforms are what one could call ‘traditional peer-to-peer lenders’, i.e. they do not lend directly to borrowers. Instead, loans put up for investment on the platforms are pre-financed by either related or unrelated companies (i.e. loan originators). Hence the terms ‘loan marketplace’ and ‘marketplace lending’ are sometimes used as these capture the underlying business model better.

While all platforms might seem similar there are certain aspects that set each platform apart. Understanding the implications of these similarities and differences should allow investors to make a more informed choice about where to invest and how.

- First, it’s the relationship between the loan originators and the platform itself. In the case of Swaper, Twino, ViaInvest, DoFinance and Robocash all loan originators within these platforms are related to the respective parent company. With Mintos, Viventor and PeerBerry loan originators include both related and unrelated companies.

- Second, it’s the interest rate offered to investors for specific loans. All platforms start around 9-10% and go up to about 17-18% for those willing to take on currency exchange related costs and risks. Most platforms gravitate towards a 12% rate as this seems to be the market equilibrium rate.

- Third, it’s the term of the underlying loans offered onto the platform. While all platforms offer short term loans (generally 5-45 days), some like Mintos, Twino and Viventor offer loans with longer terms (3-36 months).

- Fourth, it’s the availability of a BuyBack, i.e. to buy back the loan from the investor after a borrower has missed a payment for a certain amount of time (usually 30 days). Generally, all platforms offer some loans with BuyBack, but only a few offer all loans with the BuyBack (e.g. Swaper, ViaInvest, PeerBerry).

Size of the Investment Opportunities

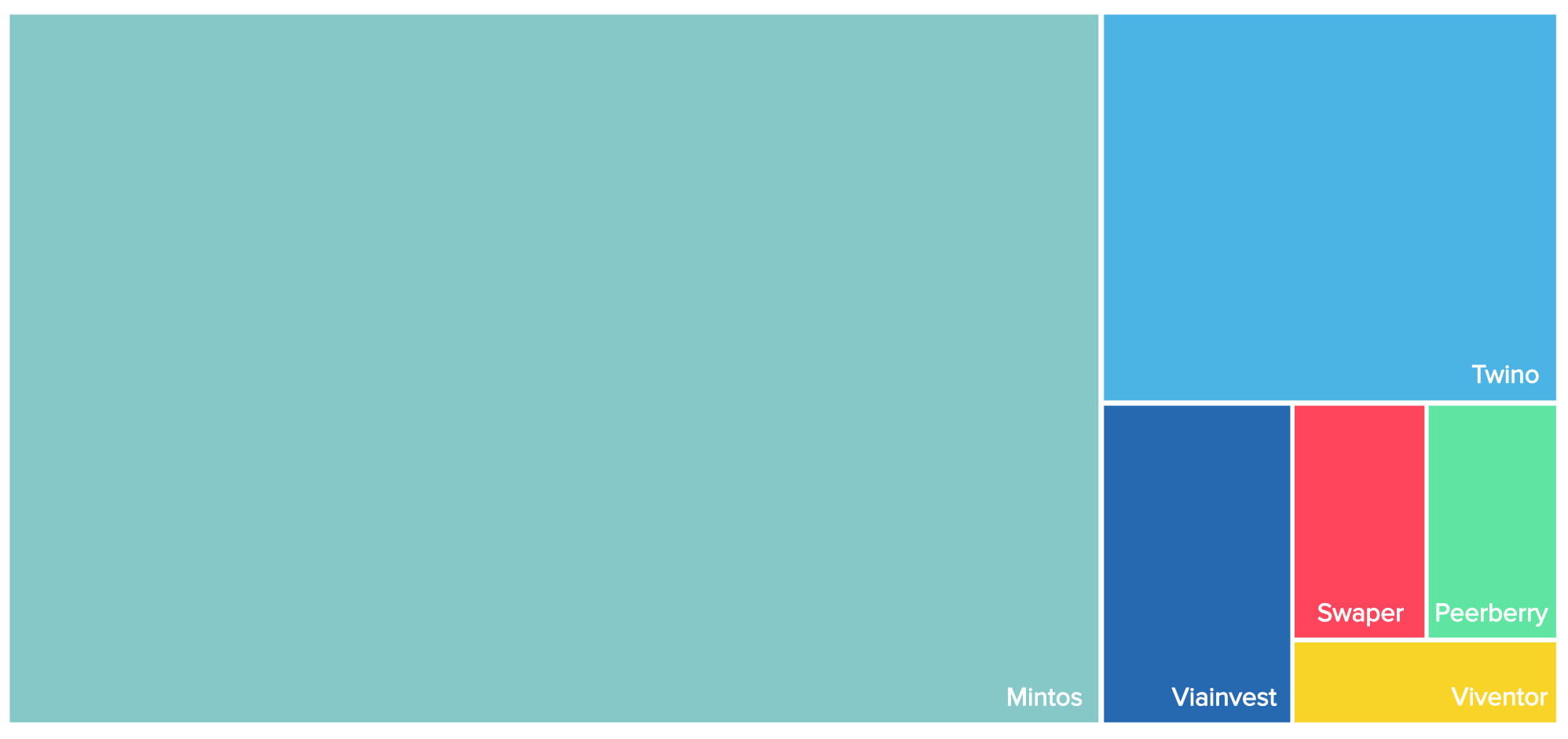

We measure the size of the market in terms of the euro amount of loans that are made available on the platform each month. The above chart is based on available data for the month of May 2018. Robocash and DoFinance have been excluded as these do not publish monthly data and hence cannot be effectively compared.

We measure the size of the market in terms of the euro amount of loans that are made available on the platform each month. The above chart is based on available data for the month of May 2018. Robocash and DoFinance have been excluded as these do not publish monthly data and hence cannot be effectively compared.

Based on available data the investment opportunity in loan marketplace platforms in Latvia is around EUR 104 million per month. If one is to assume Robocash and DoFinance to have similar numbers as, for example, Swaper or Peerberry, then that number should sit around EUR 110 million per month. The bulk of this opportunity is made up by Mintos, followed by Twino, ViaInvest, Swaper, PeerBerry and Viventor.

One has to consider that the the euro amount of added loans does not represent the total amount currently invested accross all platforms. Given that many platforms offer loans with terms ranging up to 36 months, the total number of invested funds would be much higher than the calculated 110 million.

While the opportunity is indeed substantial a cautionary note should be added that the number of current investors across all platforms is also considerable. By our estimates that number would sit around 70-80 thousand investors. Thus if each of these investors would buy an equal share of the available 110 million, then each would be buying EUR 1375 worth of loans per month. From this perspective it makes sense to consider diversifying across multiple platforms to ensure a higher likelihood of funds being invested.

#P2P #LoanMarketplace