How To Diversify Your Investments (Best Practice, Portfolio Models & Alternative Strategies)

“The beauty of diversification is it’s about as close you can get to a free lunch in investing” – Barry Ritholtz.

That Barry Ritholz quote is gold.

Because, if you’re not diversifying your investments, you’re missing out.

A lot.

Diversifying your investments is one of the best ways to lower the risk you’re taking on, increase stability, and increase returns in the long run.

But what does diversification really mean? And what does a “diversified portfolio” look like?

In this guide, we’ll be covering how to diversify your investments, how to split your investments and we’ll recommend a few alternative investment strategies.

Let’s get started.

What is portfolio diversification?

Portfolio diversification means splitting your investments into various assets rather than just one. Instead of putting all your money in the stock market, for example, you want to be putting your money in other assets such as bonds, property, gold and P2P lending.

Why? The theory goes that investing in several different assets will offer higher returns and lower risk. It’s a strategy that practically all financial advisers recommend and will vary depending on your personal goals, situation and preferences.

Instead of putting all your eggs in one basket, you want to be putting your eggs in different baskets.

The main reason diversification works is that it spreads the risk and increases exposure.

The recent downturn in March 2020 is a great example: if you only had stocks, the value of your portfolio would have dropped by 26%; if you had stocks and gold, you wouldn’t have felt the shock as much (gold reached a seven-year high of $1,702 per ounce that month).

4 Steps to diversify investments

1. Decide which assets you want to invest in

When it comes to investing, there are quite a few different assets you can choose to invest in. Here are the main ones:

- Stocks

- Bonds

- Cash

- P2P investing

- Gold

- Property

Diversification means putting a bit of all your money in these different assets.

As you’ll see below, the main question is how much to put in each basket.

2. Decide on the percentages

Your diversification strategy depends on your personal needs and goals. The assets you then decide to invest in will be allocated using percentages. So for example, 80% might be stocks, 10% bonds and 10% alternative assets.

In order to diversify your investments appropriately, you basically must allocate each asset to a percentage you’re comfortable with. See below for some examples of “model portfolios”.

3. Keep it international

There are two main ways to diversify: across various assets and across various countries and regions of the world.

When you’re investing in assets, it’s always a good idea to spread it across various regions of the world. That way, if there is a recession, pandemic or downturn in one country, you can still grow your portfolio thanks to the growth in other countries.

4. Start investing and rebalancing

In order to stick to your diversification strategy, you will need to check and rebalance your portfolio every 6 months to 1 year. For example: your allocation strategy is 60% stocks and 40% bonds. If that year stocks have been growing rapidly compared to bonds, then stocks will occupy a larger position in your portfolio – from 60% to 65%, for example.

At the end of the year, you can choose to rebalance by selling 5% of those stocks and using it to buy more bonds, maintaining your diversification strategy.

How to split your investments

The hard part is figuring out HOW to split your investments.

Those who can afford it refer to a financial adviser or an investment manager who can offer professional advice. That’s because your portfolio percentages depend on your personal circumstances, and therefore there is no “one rule fits all” strategy.

Having said that, it’s always interesting to view some examples or models of how others manage their portfolios.

These examples include “by age”, the “Swensen model” and the “Permanent portfolio” model.

By age

This is a simple and straightforward rule of thumb: subtract your age from 100 and put the percentage in stocks. If you’re 30, for example, then you should put 70% in stocks and 30% in bonds.

This rule of thumb is a really oversimplified and doesn’t take into account other asset classes that should also be part of your portfolio, such as gold, property or P2P investing.

You can elaborate on this rule by dividing it by “high return/risk and low return/risk”. If you’re 30, then put 70% in high return assets such as stocks and P2P investing, and 30% in bonds and gold, for example.

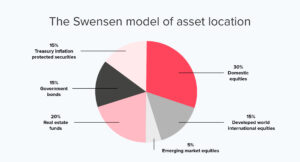

The Swensen model

The Swensen portfolio, initially called the Yale model, was invented by two Yale professors. It’s popular because it’s easy to replicate and all assets can be accessed through ETFs and low-cost investment vehicles. In this model, you are dividing between 6 different types of assets. Here’s a chart that breaks down the Swensen model:

Although it’s well-diversified, the main risk is that you will miss out on larger returns when there is a strong bull market.

The Permanent portfolio

The permanent portfolio is another well-known portfolio type designed by Harry Browne in the 1980s.

It’s also straightforward: 25% in US stocks, 25% in bonds, 25% cash and 25% in precious metals/alternative investments.

Here’s how investments are divided using the permanent portfolio model:

According to certain studies, this type of portfolio is safe for all economic climates – although, similar to other models, you might not generate higher returns when the market is doing well.

What is the best asset allocation strategy?

As you can see, the answer is that it really depends on your tolerance for risk, your age and your goals.

However, you will have seen a correlation amongst the portfolio examples:

- If you want high returns, you should have a higher percentage of your portfolio in higher risk/return assets such as stocks or P2P investing.

- If you want to reduce risk, diversify as much as possible.

- The older you get, the lower your risk should be and therefore the higher your allocation should be towards low-risk assets such as gold and bonds.

Investing in alternative investments

As a P2P platform, we believe P2P investments should play a role in your investment strategy.

P2P investing is usually classified as an alternative investment, and although that’s true, it has a huge potential of boosting your portfolio since it offers higher returns than the stock market.

The higher your returns, the faster your money will grow – and often that could be the difference between retiring at 40 and retiring at 65.

By investing through a platform like Swaper, you can get returns of 16% – a return you’ll be lucky to see in any other asset class.

That being said, understanding how to diversify your investments effectively is a topic investors have been debating for decades, even centuries.

There is no single answer.

In most cases, you’ll discover it by experimenting, working on your goals and reading how the experts invest.

Either way, one thing is for certain:

If you’re looking for higher returns, P2P investing has a place in your portfolio.