August results for the Best P2P Loan Platform

Dear Investors,

Last official month of summer has certainly treated us well. As many of you remember, August was full of updates and new features for Swaper and thus has been expectedly a busy, yet an interesting one. Besides the usual numbers, we can also take a look at some of the stats and comments about the product updates this time. And we may even have a little announcement to make. Maybe. Keep reading to find out.

We can see from our most recent statistics that our investors have earned a cumulative of 3,66m eur of return by the end of August. We added 25 773 new loans to Swaper platform last month and it’s nearly twice as many as in August ’20. The total cumulative investments count grew to 764 681, while we funded 7,06m eur worth of loans last month. Compared to August ’20, this has grown by 81%. We are certainly pleased with these results and look forward to increasing them with the help from all of our investors.

Numbers aside, we showed some other important results in August. As many of you know, we launched a number of updates and fixes to website as well as to mobile apps for both Android and iPhone last month. We amended FAQ section, created a new simulation slider for calculating your potential profits, improved many aspects of our website’s style and design and updated our privacy policy. But of course our Auto-Invest Portfolio went through the greatest transformation of them all and that’s why we would like to give you a bit of statistics and overview of that.

In a nutshell, you now have two strategies to choose from when creating a portfolio: Easy and Custom Investing, the first with preset settings and the second one for allowing you to handpick your metrics. We also broadened the criteria for portfolios in order to make sure that it would be possible to choose and divide different loan originators, countries and loan types as we plan to increase the list of the aforementioned soon. This, as well as preparing the site for getting the upcoming license will also bring upon some other system enhancements soon.

Surprisingly, a quite a significant amount of investors were so switched on that they had their new AI up and running before we even managed to send out the announcement. As of today, over 55% of our active investors have switched to the new AI strategy. 56% of these customers have chosen to set up a Custom Invest portfolio, while the rest have set up Easy Invest. Most of all, this shows that a greater portion of investors like to choose the metrics themselves. But while the ratio does not differ that widely, it also confirms that Easy Invest is also a preferred option by many investors and thus serves a purpose for a great number of them.

Overall, it seems that the new functionality and the options are quite easy to understand, which has always been our foremost intention. Of course, we have also received a few questions and suggestions regarding AI and the system updates, which we have taken on board. We find your feedback truly valuable and always share your thoughts within the team. We find that it’s a great component in truly understanding our investors and building the best loan platform on the market.

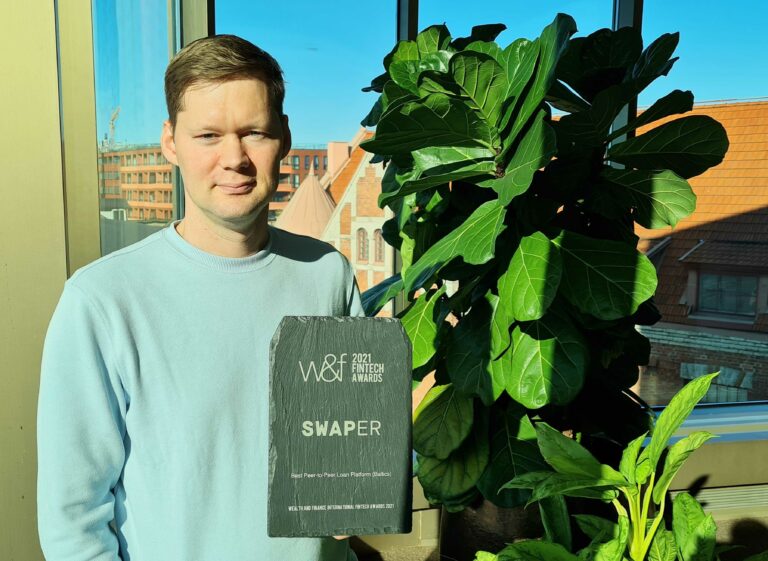

Talking about best platforms out there – Wealth and Finance International has recently announced Swaper as the winner of the Best Peer-to-Peer Loan Platform in Baltics award. This is the third year in a row for us to be recognized by them in such a way. For those who are not so familiar with the organisation – Wealth & Finance International provides fund managers and institutional and private investors with the latest investment news and does it all over the globe. To acknowledge the best performers in the field, they hand out annual awards. We take great pride in how we do things and thus are sincerely moved and thankful for winning the award for the third time in a row.

In case you are hungry to know more about alternative lending such as p2p lending, we’ve got you covered with our blog posts. You might want to look into related topics that we have covered, such as P2P Lending vs Cryptocurrency, Why to Invest in Consumer Loans and the ultimate list of 10 Best P2P Investing Forums, Blogs and Communities to help you level up Your Investment Strategies. But you can browse around the blog yourself to find something for your liking. Note that we also have a search option in our blog in case you have something specific in mind.

To put it be the words of Steve Jobs: ‘Learn continually. There’s always “one more thing” to learn’

With warm and thankful hearts we’ll be ending on this note today. Take care and talk soon!